Will tax increase make millionaires flee Minnesota?

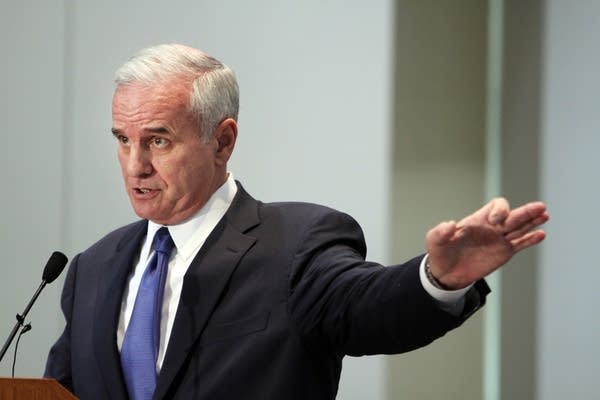

Republicans in the Minnesota House and Senate say Gov. Mark Dayton's plan to raise income taxes on Minnesota's top earners will encourage those wealthier Minnesotans move to states with lower taxes.

But a new report from New Jersey says higher taxes had little effect on who chose to live in the state.

Republicans and business leaders have hammered home the argument that Minnesota's top earners would leave the state if Dayton's tax plan is enacted.

"In other states where this has been attempted, people took action," said Rep. Linda Runbeck, R-Circle Pines at a recent committee hearing on Dayton's tax plan.

Create a More Connected Minnesota

MPR News is your trusted resource for the news you need. With your support, MPR News brings accessible, courageous journalism and authentic conversation to everyone - free of paywalls and barriers. Your gift makes a difference.

Dayton's proposal would increase Minnesota's top income tax rate to from 7.85 percent to 10.95 percent. Single filers who have an annual taxable income of 85,000 or more would be affected. So would couples with taxable incomes of $150,000 or more a year. Dayton also wants to add a 3 percent surtax on everyone earning $500,000 a year or more, which would leave Minnesota with the highest income tax rate in the country.

"Tax rates just don't make a big difference in ... where they're going to live."

Runbeck said other states that passed similar tax hikes, like Maryland, saw a dropoff in the number of top earners paying taxes.

"They left the state and it just didn't generate those kinds of revenues," she said.

Runbeck was pointing to a study of Maryland's so-called "millionaire's tax." Groups have argued that one-third of that state's wealthiest residents disappeared from the tax rolls after Maryland increased the income tax rate in 2008. Conservatives say wealthier residents left the state to avoid paying the tax.

An official with Maryland's Department of Revenue disagrees with those claims. He says the dropoff was more likely related to the economic downturn, and that there were fewer people earning enough money to make it into the higher tax bracket.

In New Jersey, researchers examined tax data to see whether a 2004 income tax hike on top earners had an impact on migration.

"Tax rates just don't make a big difference in what they decide to do in terms of where they're going to live," said Charles Varner of Princeton University, one of the researchers.

Varner and a colleague at Stanford University examined the tax returns of New Jersey residents between 2000 and 2007, including those who earned more than $500,000 a year and had to pay the higher tax starting in 2004. He said they found little difference in migration, based on who was paying the new higher taxes.

Two states within a short drive of New Jersey -- Connecticut and Pennsylvania -- have lower income tax rates. But Varner said the study did not find many wealthy New Jersey residents moving to those states to avoid paying higher taxes.

"At some point, people respond to tax increases, but it's hard to say for sure whether that would happen in Minnesota," Varner said. "But weighing everything together, it seems like it's probably not going to be that different than what happened in New Jersey."

Varner said two groups did leave the state in higher numbers -- rich people of retirement age and rich people who earn their incomes from investments. His research will be published in an upcoming edition of the National Tax Journal.

Democrats who support a higher rate in Minnesota will likely point to the study as a reason to counter Republican arguments against Dayton's plan. Dayton said last week that he didn't think Minnesota's top earners will leave if their taxes go up.

"I grew up with people who are fortunate with what they have been given and what they achieved. I just know people are better than that," said Dayton. "I think it's a scare tactic by the Republicans and others that someone making $1 million or $5 million should not pay a single dollar more in taxes."

Republican legislative leaders have argued that they don't need new revenue to erase the state's projected budget deficit of $6.2 billion. They are waiting for a new revenue forecast that will be released next Monday, before they release their budget plan.