Do tax increases kill jobs? Minn. soon to find out

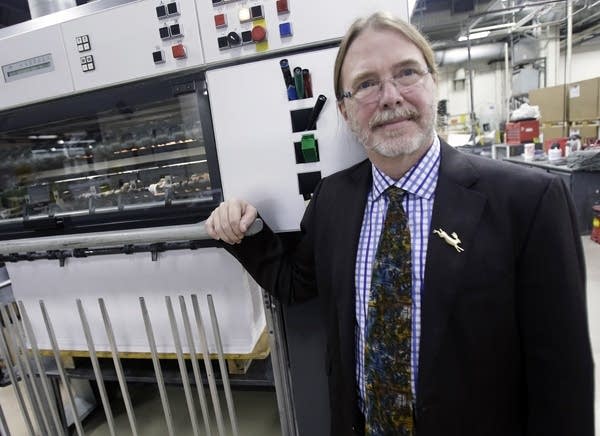

Dik Bolger is a lifelong Minnesota Democrat, a gray-bearded baby boomer with a braid down his back whose Minneapolis printing company's plant displays work by local artists and sculptors.

He backed Mark Dayton for governor, but his take on the Democratic chief executive's plan for new business taxes could be the voice-over for a Republican campaign commercial.

"We're screwed," Bolger said, if the tax goes through. His 79-year-old company competes nationwide and overseas for work with major brands like Chanel. "If you're bidding for a $100,000 job on a national basis and tax expenses push you a couple of percent higher, then I'm not competitive."

For generations, Minnesotans lived out the progressive argument that high taxes and high services were what gave the state its fabled quality of life. But the patience of business owners is being tried more than ever, as Dayton and the Democrats who now control the Capitol mull a menu of tax increases that would primarily hit company ledgers -- just as most states are going the opposite way.

Create a More Connected Minnesota

MPR News is your trusted resource for the news you need. With your support, MPR News brings accessible, courageous journalism and authentic conversation to everyone - free of paywalls and barriers. Your gift makes a difference.

Dayton has proposed tax changes he says would make the system fairer and also bring in $2 billion in new revenue. Much of the gain would come from a state sales tax on "business-to-business" purchases like legal, accounting, banking and printing costs. Few states tax such services. He would also boost Minnesota's personal income tax rates from eighth to fourth highest in the nation, behind only Hawaii, California and Oregon.

Meanwhile, many other governors_Republicans and even some Democrats-- are trying to cut their income taxes and make other changes to attract businesses. That includes many of Minnesota's neighbors in the Midwest, such as Wisconsin, Indiana, Iowa, Kansas, Missouri, Oklahoma and Nebraska.

Whether taxes kill jobs is one of the longest-running arguments in politics, and it's about to get tested in a big way in this region.

"I'm the kind of person willing to pay more in taxes because of all the attributes and benefits Minnesota offers," said John Taft, CEO of Minneapolis-based RBC Wealth Management. "But you do reach a tipping point where the cost of government gets too high and this would push us past that tipping point."

Dayton wants the new money to eliminate a $1.1 billion state budget deficit. He also wants more for public schools and colleges, job-creation programs and low-income medical assistance. He's arguing that such amenities are what perennially put the state near the top of livability lists.

"I've heard this for 30 years and I'm not insensitive to it," Dayton said of the argument that high taxes make businesses look elsewhere. However, "I say we're not the lowest-taxed state, we're the best value for people's taxes." Minnesotans try not to scoff as they contrast the state's attributes with the likes of its more down-market neighbors. Minneapolis' bustling downtown Nicollet Mall, the Twin Cities' array of theaters and first-class museums, and the state's expansive parkland and its 19 Fortune 500 company headquarters -- the second-most per capita in the country_are what make talented people want to be here, they said. It's no coincidence that Minnesota's unemployment rate is lower than Wisconsin's (5.5 percent vs. 6.6 percent in December) and its per capita income higher ($44,560 vs. $39,575).

"What's real is that quality of life is a decision-maker for the big players," says Democratic Rep. Alice Hausman.

To the east, Wisconsin is like a photo negative of Minnesota politically. On the day Dayton unveiled his tax proposal, Republican Gov. Scott Walker said he might "put a little bit more of a push" into luring Minnesota companies. He had already put Wisconsin "Open for Business" billboards along Minnesota borders; he's now pushing for a $340 million income tax cut.

South Dakota Gov. Dennis Daugaard's administration has sponsored print and radio ads and direct mail directed at unhappy executives.

"Tired of Taxes? Call Me," read the postcards.

"I can tell you that we are actively working a number of lead prospects from Minnesota," said Pat Costello, Daugaard's commissioner of economic development, though he wouldn't reveal any.

Not all of Dayton's proposed changes are increases. He wants to lower the overall sales tax rate to help middle-class families, reduce the corporate income tax and freeze business property taxes. But he's also wiping out a sacrosanct clothing exemption the Mall of America uses to attract out-of-state shoppers.

Minneapolis is the fourth-largest printing center in the U.S., according to Printing Industry Midwest, a trade association. Bolger said he's fine with paying higher personal income taxes.

But he said his Bolger Printing company had to shed more than 100 of his 320 jobs because of the recession, and "I never want to go through that again" if he starts losing jobs to lower cost competitors.

"I'm a 58-year-old Minnesota boy. Wisconsin is probably not in my future," Bolger said. "But I would have to shrink employees, decent middle class jobs. I thought that's what this is about."

___

AP reporters Brian Bakst in St. Paul, Scott Bauer and Todd Richmond in Madison, Wis., John Hanna in Topeka, Kan., Catherine Lucey in Des Moines, David Mercer in Springfield, Ill., and Sean Murphy in Oklahoma City contributed to this report.