More than 2 dozen charged in identity theft, bank fraud conspiracy

A bank supervisor, three check counterfeiters, and even a door-to-door meat seller are accused of stealing or planning to steal millions of dollars.

Federal prosecutors in Minneapolis have charged 28 people in an identity theft and bank fraud conspiracy.

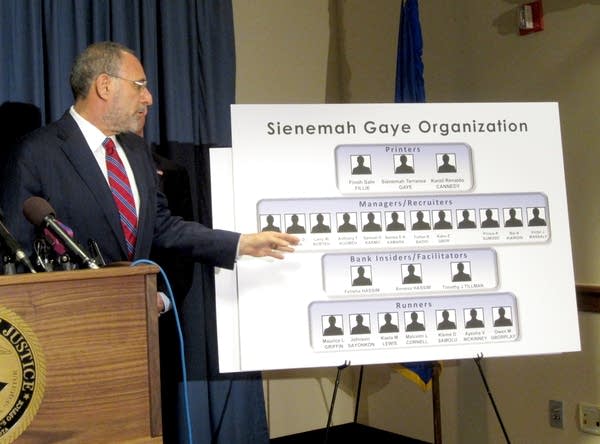

U.S. Attorney Andrew Luger said Tuesday the scheme was the largest and most sophisticated in Minnesota. He said it was highly organized, with the counterfeiters at the top, a dozen recruiters, and seven runners who cashed the phony checks.

Members of the group targeted thousands of victims over several years, Luger said. He estimated the fraud at more than $2 million.

Create a More Connected Minnesota

MPR News is your trusted resource for the news you need. With your support, MPR News brings accessible, courageous journalism and authentic conversation to everyone - free of paywalls and barriers. Your gift makes a difference.

The U.S. Attorney's office said the check manufacturers included Sienemah Terrance Gaye, 30, of Anoka, Finoh Sahr Fillie, 28, of Brooklyn Park, and Karzil Renaldo Cannedy, 23. Cannedy is being held in the Sherburne County Jail.

Two sisters, one a TCF Bank branch supervisor in Crystal and the other a Central Bank teller, stole account and other personal information from customers and gave it to the group, according to Luger.

A statement from the U.S. Attorney's office identified the bank supervisor as 20-year-old Felisha Hassim and the teller as 23-year-old Annesa Hassim. Both are from Blaine.

"They were in the jobs and they were recruited by the organization to assist the organization," Luger said.

The door-to-door meat salesman stole account information when customers paid by check, according to the charges. The group also allegedly swiped account numbers from photos of paychecks people posted on social media, some using the #myfirstpaycheck hashtag.

Luger said social media postings on Instagram revealed other personal information, like check routing numbers.

"That's the kind of information that's critical to a criminal organization like this," Luger said.

Mark Goldman, a spokesman for TCF Bank, said the bank has been cooperating with authorities since the investigation's early stages, and none of its customers lost any money as a result of the scheme. Goldman said the former branch supervisor has not worked at TCF since December 2012.

Most of the 25 who were indicted and three others who were charged separately have made initial court appearances.

The Associated Press contributed to this story.