$45K windfall is a lesson for Ojibwe teens

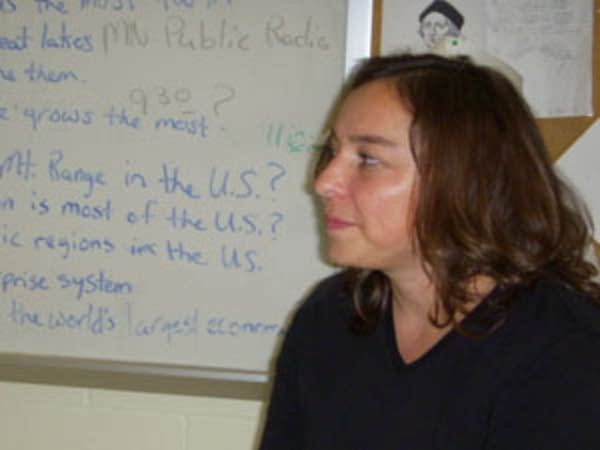

At the Fond du Lac Ojibwe School, teacher Jennifer Johnson is trying to get her students to think about the value of money.

"How much did you pay for that water?" she asks one of her students.

"A dollar," replies student Steph Shabaiash.

"And that's $6 a gallon if you add up the ounces," Johnson points out.

Create a More Connected Minnesota

MPR News is your trusted resource for the news you need. With your support, MPR News brings accessible, courageous journalism and authentic conversation to everyone - free of paywalls and barriers. Your gift makes a difference.

"This is some expensive water!" Steph laughs.

Jennifer Johnson is managing to get her class to grasp the value of a dollar. Take that dollar and multiply it by 45,000. That's the kind of money her students are about to get.

"Well, it's a big chunk of money," Johnson says. "They usually blow it."

Wait. They blow it?

"Oh sure," Johnson says. "It's like your parents giving you an allowance ... you just blow it because you didn't have to work for it, really."

Johnson says she's seen some students go through that money in less than a month. Gone, just like that -- no savings accounts, no stock investments, no college funds. Seems insane, right?

I asked her class, how does that happen with so much money?

"Because it's there in your pocket!" one student says.

"It's fun to go shopping!" explains another.

They say just having money makes them want to do something -- buy a car or two cars, or a take a trip to Jamaica. Johnson says in the worst cases, students go crazy with their money and spend it on drugs and booze until they've got nothing left.

The students in her current class plan to save, but they say it's hard. Especially when friends, cousins and even parents are already asking them for gifts.

"They're scavengers!" jokes student Danny Tiessen.

He laughs about it now, but he says it can be stressful. According to Johnson, sharing is a big part of Ojibwe culture -- even when it comes to money. Many students end up buying cars or vacations for their families with the money they hoped to use for themselves.

Still, every single one of them says it's worth the hassle. And really, who would disagree? Forty-five thousand dollars is a ton of money. And between computers, cars and sound systems, there's a lot to tempt a teenager.

It makes you wonder, who would save?

Well, Matt Hammitt did. He's 20 years old, and a student at the College of St. Scholastica in Duluth. When he got his share of the tribal money, he put it into a CD account.

"For me, I just like having that sense of security," Hammitt explains.

His friends pressured him to spend it, but he held out.

"I have to say that I was definitely tempted to, but I figured I would probably want that money for something like a house after college," says Hammitt.

But Hammitt's situation is pretty unique. His mom is the accountant for the Ojibwe tribe, so he's grown up surrounded by money, and people who know how to manage it.

That's not the case for everyone on the reservation. The average per-capita income is less than $15,000. Many families live paycheck to paycheck.

Kris Stiffarm says that's how his family gets by. When he turned 18 earlier in the month, he cashed his $45,000 check and went shopping.

"It took me two weeks until I was back down to zero." Kris admits. "I ran into a lot of stuff I wanted to buy."

A lot of stuff for Kris means two trucks, three ATVs, a speedboat, a trailer and a Playstation 3.

It's not fair to say Kris spent all his money.

"Oh yeah, I put [aside] like $500, for my baby," Kris says.

His girlfriend is expecting a child. He keeps his kid's future inheritance hidden in his bedroom.

"Every day I throw in my loose change and my small dollars and something in there. Save it."

Kris shows me the house where he lives. The yard is littered with vehicles. Kris knows the specs and value of each one by heart.

There's no doubt he's proud of his purchases. But you can't help wonder -- his family isn't rich and with a baby on the way, why would he spend all that money on cars and boats?

"It's an investment," Kris explains. "My boat right now is worth $17,000 and the trailer is worth $5,000. I could sell it and buy a new car or something."

And unlike some of his friends who blew their windfall on drugs and parties, Kris has something to show for his money. The ATVs and trucks are a way for him to see his wealth. And, these things give Kris a sense of financial security.

Kind of like Matt Hammitt and his CD account.

These are the kinds of things Jennifer Johnson wants her students to be thinking about. She knows a lot of her students might never see this kind of money again. But that doesn't mean they have to blow it.

"You just need to discipline yourself on what those true wants really are," Johnson advises. "Some will get it, some won't and some we'll never know."

The lesson she wants her students to take away isn't that you have to save all your money. But if you are going to spend it, consider your options, know what's important to you and make it count.