Dayton's loan plan draws skepticism, interest

Go Deeper.

Create an account or log in to save stories.

Like this?

Thanks for liking this story! We have added it to a list of your favorite stories.

The governor's new plan to spur lending at community banks draws reaction that ranges from skeptical to interested.

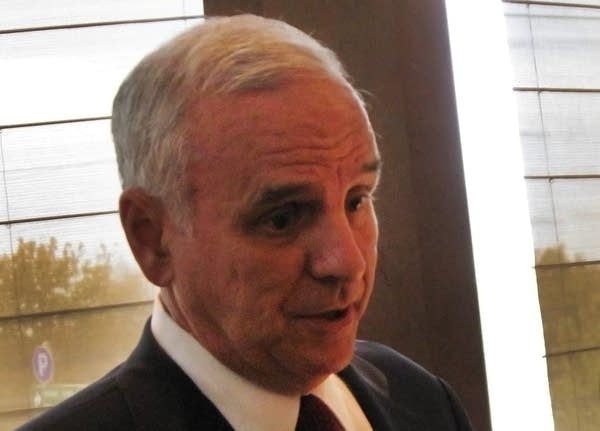

Gov. Mark Dayton wants to pump as much as $200 million into certificates of deposit at community banks to provide funding and encourage lending to businesses that seek to grow. The money would come from state pension funds that are currently invested in US treasury bills.

The governor's plan expands a program that's been around for 30 years and has invested a cumulative $4 billion in local banks.

That program hasn't required a formal process to select banks to get the funds, said officials with the state board of investment. The money is available to qualified banks that make a request.

Turn Up Your Support

MPR News helps you turn down the noise and build shared understanding. Turn up your support for this public resource and keep trusted journalism accessible to all.

Those lenders must have a rating from the State Commerce Department of at least "satisfactory," and also be rated "well capitalized" by the FDIC.

And no bank can get more than the FDIC will insure, to keep the pension funds safe.

"In the past, it's been a very successful program. Banks took those funds and they really represented low-cost or reasonable deposits that community banks have access to," said Marshall MacKay, head of the Independent Community Bankers of Minnesota.

MacKay said the governor's expansion of the program is a positive step for long-term benefit.

"Many banks use that as a means to gather deposits and in turn lend out," said MacKay.

But in the short-term, MacKay said the plan might not make much difference.

Banks are already sitting on a lot of cash. Deposits at Minnesota banks have increased 10 percent since the financial crisis in 2008 as both individuals and businesses park more money in banks, according to the Federal Reserve Bank of Minneapolis.

Deposits in the Twin Cities have nearly doubled in the past five years.

However, loan growth has remained tepid. MacKay said that has to do with both federal regulators tighter lending standards and businesses' reluctance to borrow money in a bad economy — issues that the governor's proposal does not address.

"I have some concerns as to whether Gov. Dayton expects that will immediately stimulate additional lending to small businesses and consumers," MacKay said.

There could be some interest on the part of businesses looking to borrow, said Bill Blazar of the Minnesota Chamber of Commerce, the state's largest business organization. Blazar was part of the governor's task force looking at ways to improve capital access for small businesses.

"It kind of creates some excitement. Some will read it as, 'Hey, there is money here,'" he said.

Dayton understands the state's economy needs a boost and is looking for any way to offer it, Blazar said, and this plan fits the bill.

"It's completely consistent that they'd be looking for things that can be done immediately and without need for additional legislation," Blazar said.

And without any additional cost. If anything, the state could benefit from shifting pension funds into CDs and out of treasuries. The interest rates on the bank CDs could be slightly better.

However, the plan has its skeptics.

Jim Holm, an insurance underwriter in Plymouth, is unconvinced the plan will make much of a difference for businesses like his. Holm said he's had a difficult time getting credit, and sees the same problem at the companies he does business with.

"It's a numbers game. And if you don't fit the ratios, you're not going to get the loan," he said.

Holm said he's seen a lot of companies flame out and close, often due to lack of credit.

"And it's not because the banks don't have money in them. The banks have a lot of money in them," he said.

But many banks would gladly take the deposits and put them to use for lending, said Tom Borman, chairman of the governor's capital access task force for small business.

Borman is a founder and owner of Tradition Capital Bank in Edina. He recently spoke with the bank's CEO to tell him about the program.

"And I said 'Here's what we're considering. Do we want more deposits?' And he said, 'Absolutely,'"

And many bank executives will feel the same way, Borman said.

Dear reader,

Your voice matters. And we want to hear it.

Will you help shape the future of Minnesota Public Radio by taking our short Listener Survey?

It only takes a few minutes, and your input helps us serve you better—whether it’s news, culture, or the conversations that matter most to Minnesotans.