UCare ending operations, moving all remaining health insurance enrollees to Medica

Minnesota-based nonprofit health insurer UCare announced Monday that it is ending operations and moving all its remaining members to Medica.

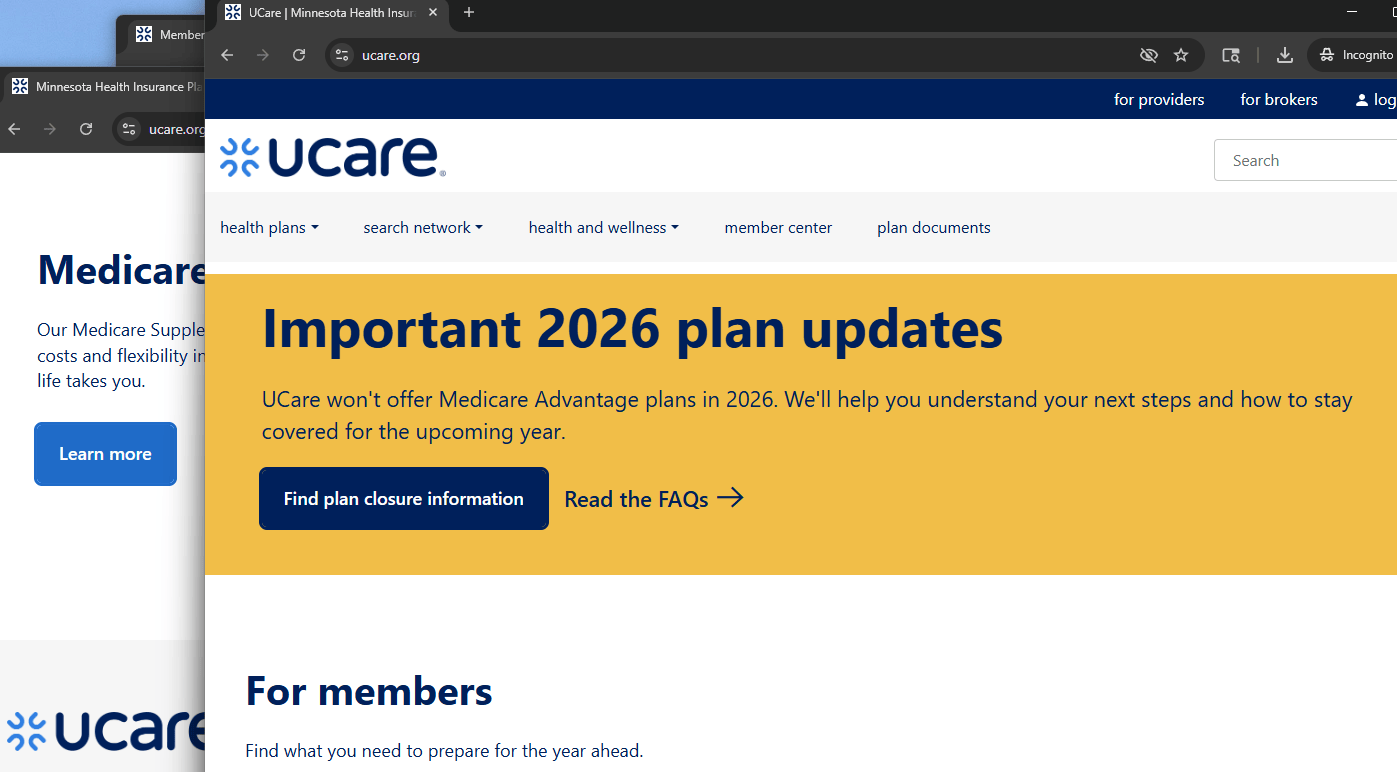

Screenshot | MPR News

Go Deeper.

Create an account or log in to save stories.

Like this?

Thanks for liking this story! We have added it to a list of your favorite stories.

Audio transcript

NINA MOINI: One of Minnesota's largest health insurers, UCare, is shutting down at the start of next year. The Minnesota-based insurer has more than 300,000 members across Minnesota and Western Wisconsin, many of whom are on Medicare or Medicaid plans. Those members will be transferred to the insurer Medica and will be able to stay on their plan. The shuttering of UCare brings up questions about insurance options for Minnesota's most vulnerable.

Joining me now with some insight is Stephen Parente. He's a professor of finance at Minnesota's Carlson School of-- I'm sorry, Minnesota Carlson and the Minnesota Insurance Industry Chair of Health Finance. It's a long title. I'm sure you've earned it. Stephen--

[LAUGHTER]

--thanks for being with us. Sorry about that.

STEPHEN PARENTE: No worries. At least we shortened the school's name to Minnesota Carlson. So there's that.

NINA MOINI: The University of Minnesota Carlson School of Management, to be exact.

STEPHEN PARENTE: Exactly.

NINA MOINI: So UCare's biggest customer was, again, people on Medicaid or Medicare. But that ended up being the downfall for the company. Can you explain that?

STEPHEN PARENTE: Yeah, so those programs are largely from the state and also federal funds, which is the Medicaid program, and then also Medicare for the elderly population, as well. And so the good news, if you're in those programs, is that, if your trends are working in the right direction, those cost trends, they work really well for you. But if you get shocks, they are a problem.

And the other issue is a diversification question. So UCare had a tremendous, and has had a tremendous, public mission in terms of serving folks that are poor as well as folks that are elderly in that market. But they did not necessarily reach as much to get folks that were in the commercial market for employers, which is actually a good, if you will, hedge in case some of the rules, regs, and trends in the government programs turn against you.

NINA MOINI: Can you remind us, too, just how Medicare and Medicaid programs are funded, how the insurers play a role in that?

STEPHEN PARENTE: Sure. So in the case of Medicaid, which is really designed for folks that are disadvantaged financially, in that case, the funds come from the state. But there's also initially a federal match, but there's also additional monies that came from the Affordable Care Act that make it available to the state.

Now, in the past, many states would run their own Medicaid programs with government employees. But a trend that emerged about 20 or 30 years ago was to actually have companies do that work instead of the state just for operational efficiencies. And UCare made it one of their specialties to actually take that responsibility on.

In the case of Medicare, that program is run by the federal government. It's been around since 1966. And what typically the Medicare program is-- has always been sort of self-contained. That's traditional Medicare. But seniors have the opportunity to buy a plan offered by private insurers known as Medicare Advantage. It's been around since 2003, and that's available coast to coast.

And actually, in the last few years, that's become the dominant version of Medicare. Over 50% of seniors now get their coverage there. And UCare care was very much into both of those markets.

NINA MOINI: OK. I think what's confusing about it, too, is this idea that everything will sort of just transfer over. And that leaves maybe people thinking, oh, this won't be that big of a deal. It won't impact me. But I wonder, how does this sort of consolidation impact people searching for this type of coverage and just the industry at large?

STEPHEN PARENTE: That is a challenge. I mean, hopefully, the transition may be somewhat smooth, in the sense that plans-- seniors right now choosing, say, their Medicare Advantage plans are doing that, really, right now. And it's a question of what options are going to be available.

In the case of UCare, my understanding is that the assets of UCare will go to Medica. And Medica is still in the Medicare Advantage market. It just means that there's one less plan that's there. UnitedHealthcare is in that market. Humana is in that market. So there are a lot of national plans still available to Minnesotans for Medicare Advantage. Hopefully, I mean, it just means one that people might have really liked and enjoyed, being UCare, is just not going to be available going forward.

NINA MOINI: So, Stephen, I wonder if you have any advice for folks. In open enrollment season here, what is the landscape like for Minnesotans right now? What would you advise?

STEPHEN PARENTE: Well, I mean, I would advise, if you're a senior, look and see some of the benefits, the extra benefits that come along with these plans. It's actually been one of the features of Medicare Advantage, where it's not just entirely health insurance, but there's also some wellness initiatives. There's some health club components to it. There's some nutrition programs, as well. And there's variation in all of those. In terms of the plans. I mean, they're actively competing.

And the other advice I'd give is, if you haven't already, start early because this happens a lot, even for people I know at the university, where we have to choose our benefits. And you do it, you know, five minutes before midnight. [LAUGHS] And you kind of want to give yourself a little bit of time to look around and see what's available. But most of the shopping really is by the internet, though there are phone call or phone lines you can call as well for, basically, navigators for the Medicare programs.

NINA MOINI: All right, Stephen, really appreciate your time. Thank you for stopping by and sharing your knowledge with us.

STEPHEN PARENTE: Sure, absolutely.

NINA MOINI: Thank you. That was Professor Stephen Parente.

Joining me now with some insight is Stephen Parente. He's a professor of finance at Minnesota's Carlson School of-- I'm sorry, Minnesota Carlson and the Minnesota Insurance Industry Chair of Health Finance. It's a long title. I'm sure you've earned it. Stephen--

[LAUGHTER]

--thanks for being with us. Sorry about that.

STEPHEN PARENTE: No worries. At least we shortened the school's name to Minnesota Carlson. So there's that.

NINA MOINI: The University of Minnesota Carlson School of Management, to be exact.

STEPHEN PARENTE: Exactly.

NINA MOINI: So UCare's biggest customer was, again, people on Medicaid or Medicare. But that ended up being the downfall for the company. Can you explain that?

STEPHEN PARENTE: Yeah, so those programs are largely from the state and also federal funds, which is the Medicaid program, and then also Medicare for the elderly population, as well. And so the good news, if you're in those programs, is that, if your trends are working in the right direction, those cost trends, they work really well for you. But if you get shocks, they are a problem.

And the other issue is a diversification question. So UCare had a tremendous, and has had a tremendous, public mission in terms of serving folks that are poor as well as folks that are elderly in that market. But they did not necessarily reach as much to get folks that were in the commercial market for employers, which is actually a good, if you will, hedge in case some of the rules, regs, and trends in the government programs turn against you.

NINA MOINI: Can you remind us, too, just how Medicare and Medicaid programs are funded, how the insurers play a role in that?

STEPHEN PARENTE: Sure. So in the case of Medicaid, which is really designed for folks that are disadvantaged financially, in that case, the funds come from the state. But there's also initially a federal match, but there's also additional monies that came from the Affordable Care Act that make it available to the state.

Now, in the past, many states would run their own Medicaid programs with government employees. But a trend that emerged about 20 or 30 years ago was to actually have companies do that work instead of the state just for operational efficiencies. And UCare made it one of their specialties to actually take that responsibility on.

In the case of Medicare, that program is run by the federal government. It's been around since 1966. And what typically the Medicare program is-- has always been sort of self-contained. That's traditional Medicare. But seniors have the opportunity to buy a plan offered by private insurers known as Medicare Advantage. It's been around since 2003, and that's available coast to coast.

And actually, in the last few years, that's become the dominant version of Medicare. Over 50% of seniors now get their coverage there. And UCare care was very much into both of those markets.

NINA MOINI: OK. I think what's confusing about it, too, is this idea that everything will sort of just transfer over. And that leaves maybe people thinking, oh, this won't be that big of a deal. It won't impact me. But I wonder, how does this sort of consolidation impact people searching for this type of coverage and just the industry at large?

STEPHEN PARENTE: That is a challenge. I mean, hopefully, the transition may be somewhat smooth, in the sense that plans-- seniors right now choosing, say, their Medicare Advantage plans are doing that, really, right now. And it's a question of what options are going to be available.

In the case of UCare, my understanding is that the assets of UCare will go to Medica. And Medica is still in the Medicare Advantage market. It just means that there's one less plan that's there. UnitedHealthcare is in that market. Humana is in that market. So there are a lot of national plans still available to Minnesotans for Medicare Advantage. Hopefully, I mean, it just means one that people might have really liked and enjoyed, being UCare, is just not going to be available going forward.

NINA MOINI: So, Stephen, I wonder if you have any advice for folks. In open enrollment season here, what is the landscape like for Minnesotans right now? What would you advise?

STEPHEN PARENTE: Well, I mean, I would advise, if you're a senior, look and see some of the benefits, the extra benefits that come along with these plans. It's actually been one of the features of Medicare Advantage, where it's not just entirely health insurance, but there's also some wellness initiatives. There's some health club components to it. There's some nutrition programs, as well. And there's variation in all of those. In terms of the plans. I mean, they're actively competing.

And the other advice I'd give is, if you haven't already, start early because this happens a lot, even for people I know at the university, where we have to choose our benefits. And you do it, you know, five minutes before midnight. [LAUGHS] And you kind of want to give yourself a little bit of time to look around and see what's available. But most of the shopping really is by the internet, though there are phone call or phone lines you can call as well for, basically, navigators for the Medicare programs.

NINA MOINI: All right, Stephen, really appreciate your time. Thank you for stopping by and sharing your knowledge with us.

STEPHEN PARENTE: Sure, absolutely.

NINA MOINI: Thank you. That was Professor Stephen Parente.

Download transcript (PDF)

Transcription services provided by 3Play Media.